Zomato is one of India’s most recognized food delivery and restaurant discovery platforms, connecting millions of users with their favorite meals and dining experiences. With the rapid growth of India’s digital economy and increasing preference for online food delivery, Zomato has emerged as a leader in the industry. The company’s focus on innovation, such as AI-driven logistics and cloud kitchens, has positioned it as a forward-thinking brand.

This article will discuss Zomato’s share price targets for 2025 to 2030. These forecasts consider market trends, the company’s growth plans, and its ability to adapt to changing consumer needs. Whether you’re an investor looking to assess Zomato’s long-term potential or simply curious about its financial future, this guide offers valuable insights.

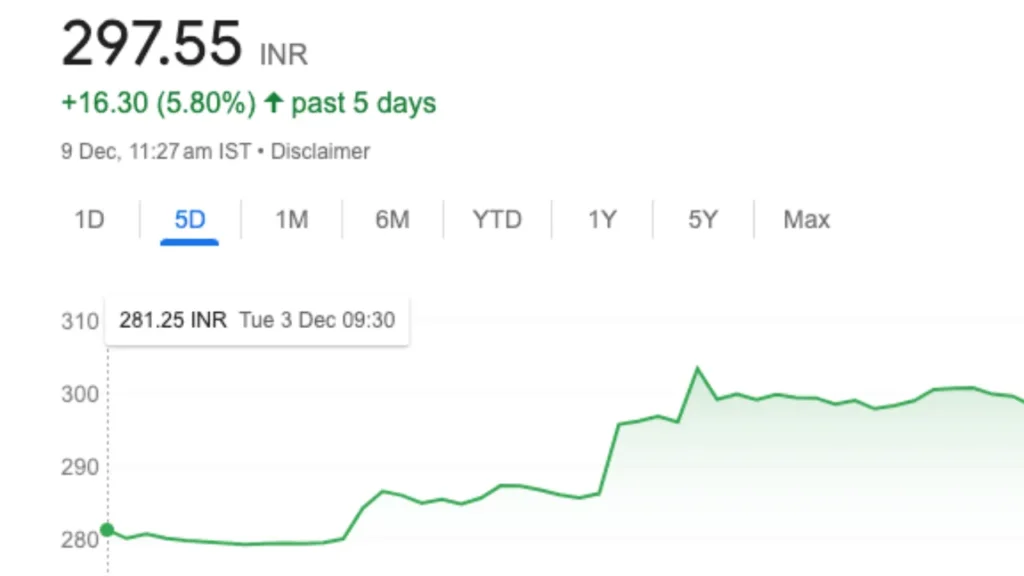

Zomato Share Price Target for 2025

Target Range: ₹290 – ₹300

In 2025, Zomato is expected to continue leveraging its leadership in the online food delivery market. Expansion into Tier 2 and Tier 3 cities, along with its push toward profitability, could drive the share price. Partnerships with restaurant chains and cloud kitchen initiatives are also likely to enhance revenue streams.

Zomato Share Price Target for 2026

Target Range: ₹310 – ₹455

By 2026, Zomato’s focus on improving operational efficiency and implementing AI-driven logistics solutions could significantly boost profitability. Increased consumer spending on digital services and the growth of India’s middle class will support its upward momentum.

Zomato Share Price Target for 2027

Target Range: ₹430 – ₹545

In 2027, the company is poised to benefit from its investments in alternate revenue streams, such as B2B food supplies. Expansion into international markets and further penetration of rural India will likely fuel growth. The increasing adoption of online services in India adds to its potential.

Zomato Share Price Target for 2028

Target Range: ₹550 – ₹570

The year 2028 could mark Zomato’s further evolution into a comprehensive food ecosystem provider. Collaborations with fintech players and loyalty programs could enhance customer retention and increase average order values.

Zomato Share Price Target for 2029

Target Range: ₹580 – ₹600

Zomato’s continued investment in technology and its focus on sustainability, including eco-friendly delivery methods, could strengthen its brand image and market share. Rising revenue from premium services and advertising could also add to its valuation.

Zomato Share Price Target for 2030

Target Range: ₹620 – ₹750

By 2030, Zomato is likely to solidify its dominance in the Indian food-tech market. Strategic acquisitions, improved profitability, and a mature ecosystem of services could result in significant shareholder value. The long-term potential of India’s digital economy will be a critical growth driver.

Consolidated Price Targets for Zomato Shares

| Year | Target Range (₹) | High (₹) | Low (₹) |

|---|---|---|---|

| 2025 | 290 – 300 | 300 | 290 |

| 2026 | 310 – 455 | 455 | 310 |

| 2027 | 430 – 545 | 545 | 430 |

| 2028 | 550 – 570 | 570 | 550 |

| 2029 | 580 – 600 | 600 | 580 |

| 2030 | 620 – 750 | 750 | 620 |

FAQs About Zomato Share Price Predictions

1. Is Zomato a good long-term investment?

Zomato holds strong potential as a long-term investment, given its leadership in the food delivery market and its focus on innovation, customer experience, and profitability. With India’s growing digital economy and rising middle-class population, Zomato is well-positioned for sustainable growth over the coming years.

2. What are the predicted Zomato share prices for 2030?

By 2030, Zomato’s share price is forecasted to range between ₹220 and ₹250. This prediction is based on its expansion plans, technological advancements, and expected growth in revenue streams.

3. What factors are driving Zomato’s stock price growth?

Several factors influence zomato’s stock price growth

- Expansion into Tier 2 and Tier 3 cities

- Investments in cloud kitchens and B2B food supply services

- Adoption of AI-driven logistics solutions

- Strategic partnerships and acquisitions

- Increased consumer spending on digital services

4. Are there risks involved in investing in Zomato shares?

Yes, investing in Zomato shares involves risks such as:

- Intense competition from other food delivery platforms

- Regulatory challenges in India’s digital economy

- Fluctuations in profitability as the company continues its growth journey

- Dependency on consumer behavior, which can be influenced by economic conditions

5. Can Zomato’s shares outperform other food delivery companies in the future?

Zomato’s strong brand, technological innovations, and focus on market expansion give it a competitive edge over other food delivery companies. However, its ability to sustain long-term growth and profitability will depend on how effectively it manages competition and operational challenges.

6. How does Zomato plan to achieve profitability?

Zomato aims to achieve profitability by improving operational efficiency, reducing delivery costs, and expanding into higher-margin revenue streams like B2B food supplies and premium subscription services. The company also focuses on increasing average order values and retaining customers through loyalty programs.

7. Is Zomato expanding internationally?

While Zomato’s primary market is India, it has explored international expansion in the past and continues to evaluate growth opportunities in global markets. The success of such ventures depends on market dynamics and competition in the targeted regions.

8. Should I invest in Zomato shares now?

Investing in Zomato shares can be considered if you believe in the long-term growth potential of India’s food delivery sector. However, it’s important to assess your financial goals, risk tolerance, and the company’s performance before making an investment decision.

9. How does the rising digital economy in India benefit Zomato?

India’s growing digital economy directly benefits Zomato by increasing the adoption of online food delivery services. A tech-savvy, young population and rising disposable income contribute to Zomato’s market growth. Additionally, the shift toward convenience and digital payments creates a favorable environment for the company’s expansion.

Also Read: ITC Share Price Targets for 2025 to 2030

Conclusion

Zomato’s journey reflects the growing importance of convenience and digital solutions in today’s economy. With strong growth prospects, innovative strategies, and a firm hold on the Indian food delivery market, Zomato offers significant potential for long-term investors.

However, as with any investment, understanding the risks and market conditions is crucial before making a decision. By keeping an eye on Zomato’s performance and the broader industry, investors can make informed choices to align with their goals.

1 thought on “Zomato Share Price Targets for 2025 to 2030”