Adani Wilmar Limited (AWL) is a prominent name in India’s fast-moving consumer goods (FMCG) sector. Founded in 1999, it is a collaborative venture between the Adani Group, a leading Indian conglomerate, and Wilmar International, Asia’s leading agribusiness group. The company is best known for its flagship brand Fortune, which dominates the edible oil market in India. Beyond oils, Adani Wilmar has diversified into packaged foods, including rice, wheat flour, and sugar, catering to millions of households across the country.

This article explores Adani Wilmar’s share price targets and predictions for the years 2025, 2026, 2027, 2030, 2035, 2040, and 2050. With the FMCG sector growing rapidly and the company’s strategic focus on sustainability and innovation, Adani Wilmar is well-positioned for significant market expansion. We’ll delve into factors influencing its stock performance, including market trends, the impact of government policies, and its diversified product portfolio.

Whether you’re considering an investment or simply curious about its future, this article provides a detailed and easy-to-understand analysis of Adani Wilmar’s growth trajectory and share price potential.

Adani Wilmar Share Price Target For 2025

Adani Wilmar’s share price is expected to range between ₹525 and ₹575. This moderate growth reflects the company’s focus on expanding its product portfolio in edible oils and packaged foods. Factors like steady market demand and effective branding strategies for Fortune products will likely drive this growth.

Adani Wilmar Share Price Target For 2026

In 2026, the share price is projected to be between ₹600 and ₹650. With increasing market penetration and expansion into value-added food products, AWL is likely to benefit from growing consumer trust in its offerings. Government incentives for agribusinesses could also positively impact revenue.

Adani Wilmar Share Price Target For 2027

The price is expected to range from ₹700 to ₹750 by 2027. Expansion into international markets and continuous improvements in supply chain efficiency will support this growth. The rising popularity of ready-to-cook meals will add a new revenue stream.

Adani Wilmar Share Price Target For 2030

For 2030, projections suggest a price range of ₹1000 to ₹1200. By this time, Adani Wilmar may establish itself as a dominant player in the global food processing industry. Technological advancements and significant investments in sustainability are likely to increase its valuation.

Adani Wilmar Share Price Target For 2035

By 2035, the stock is predicted to reach ₹1900 to ₹2000. Growth will be driven by diversification into high-margin products and an expanding customer base. Innovations in plant-based food solutions and stronger export potential will further boost profitability.

Adani Wilmar Share Price Target For 2040

The projected price for 2040 ranges from ₹2900 to ₹3000. The company’s consistent growth trajectory, aligned with India’s economic expansion and increased consumer spending, will support its position as a market leader. Strategic acquisitions may also fuel growth.

Adani Wilmar Share Price Target For 2050

By 2050, Adani Wilmar’s share price could achieve a high of ₹5000 to ₹5500, based on sustained demand, innovation, and global expansion. This growth would reflect decades of operational excellence and market adaptability.

Consolidated Adani Wilmar Share Price Targets and Predictions (2025–2050)

| Year | Low Target (₹) | Medium Target (₹) | High Target (₹) |

|---|---|---|---|

| 2025 | 525 | 550 | 575 |

| 2026 | 600 | 625 | 650 |

| 2027 | 700 | 725 | 750 |

| 2030 | 1000 | 1100 | 1200 |

| 2035 | 1900 | 1950 | 2000 |

| 2040 | 2900 | 2950 | 3000 |

| 2050 | 5000 | 5250 | 5500 |

Is Adani Wilmar a good investment for the long term?

Adani Wilmar is positioned as a solid long-term investment in India’s FMCG sector, backed by the Adani Group’s strong brand and a diversified product portfolio. The company has a significant market share in edible oils and growing contributions from packaged foods, flour, and sugar.

With India’s rising demand for branded food products and increasing rural market penetration, Adani Wilmar’s growth prospects are strong. According to our price predictions, the stock could see significant appreciation over the years, with potential highs of ₹750 by 2030 and ₹1,200 by 2040, reflecting robust growth opportunities. However, investors should consider broader market risks and raw material price fluctuations before committing to long-term investments.

What is the predicted share price of Adani Wilmar in 2025?

For 2025, Adani Wilmar’s share price is projected to range between ₹450 (low target) and ₹520 (high target). These predictions are based on the company’s consistent revenue growth and its ability to manage supply chain disruptions efficiently.

The expansion into new product categories and the rural market is likely to contribute significantly to this growth. As India’s FMCG sector expands further, Adani Wilmar’s focus on affordability and quality positions it well for achieving these targets.

What will Adani Wilmar’s share price be in 2030?

By 2030, Adani Wilmar’s share price is predicted to range from ₹700 (low target) to ₹750 (high target). These projections account for the company’s continued dominance in edible oils and packaged food sectors, along with its ability to tap into export opportunities.

India’s growing preference for branded food products and increasing disposable income are expected to be major growth drivers. However, achieving these targets will require effective management of commodity price fluctuations and sustained profitability in competitive markets.

What are the key factors affecting Adani Wilmar’s stock price?

Adani Wilmar’s stock price is influenced by several key factors:

- Raw Material Costs: Fluctuations in global palm oil and other edible oil prices directly affect margins.

- Consumer Demand: Growing urbanization and health-conscious trends drive demand for branded and fortified products.

- Market Expansion: Increased rural penetration and export growth are critical contributors.

- Regulatory Environment: Government policies on imports and edible oil prices significantly impact the company.

Adani Wilmar’s ability to innovate and adapt to these factors will determine its share price trajectory.

How does Adani Wilmar compare to its peers in the FMCG sector?

Adani Wilmar holds a competitive edge over its peers due to its strong brand presence, integrated supply chain, and focus on affordability. Unlike larger players like Nestlé or Hindustan Unilever, Adani Wilmar is still growing aggressively in rural markets and expanding its product portfolio.

The company’s dual focus on essentials (like edible oils) and discretionary goods (packaged foods) gives it a well-balanced risk-reward profile. However, its reliance on raw material imports may make it more vulnerable to commodity price fluctuations compared to local competitors.

Here are detailed answers for the additional H2 questions based on Adani Wilmar’s potential growth and financial outlook:

What is Adani Wilmar’s growth strategy for the future?

Adani Wilmar’s growth strategy revolves around diversification, rural expansion, and innovation:

- Expanding Product Portfolio: The company is focusing on expanding beyond edible oils into value-added food products such as packaged wheat flour, rice, and sugar. This diversification helps capture a larger share of the growing FMCG market in India.

- Rural Penetration: With an extensive distribution network, Adani Wilmar is increasing its reach in India’s rural areas, which contribute significantly to its revenue growth.

- Export Opportunities: By leveraging its strong supply chain, the company is targeting international markets, especially in South Asia and the Middle East.

- Sustainability Initiatives: Adani Wilmar is adopting sustainable practices and launching healthier product variants to cater to rising health-conscious consumers.

These strategies are likely to fuel revenue growth, with projected share price targets of ₹750 by 2030 and ₹1,200 by 2040, assuming continued execution of its plans.

What risks should investors consider before investing in Adani Wilmar?

Investing in Adani Wilmar involves the following risks:

- Commodity Price Volatility: The company heavily depends on imports for raw materials like palm oil. Fluctuating global prices can impact profitability.

- Regulatory Changes: Policies related to import duties, edible oil pricing, or food safety regulations can affect operations.

- Intense Competition: The FMCG sector is highly competitive, with established players like Hindustan Unilever and ITC posing challenges.

- Dependency on Edible Oils: Although diversifying, a significant portion of Adani Wilmar’s revenue still comes from edible oils, making it vulnerable to changes in demand or costs.

- Economic Slowdowns: Consumer spending on branded food products can decline during economic uncertainties, affecting sales growth.

Despite these risks, the company’s strong market presence and growth strategies make it a promising long-term investment.

What is the company’s performance in terms of revenue and profit growth?

Adani Wilmar has demonstrated consistent revenue growth, supported by its diversified product offerings and efficient supply chain. Over the past three years, the company’s revenue has grown at an average of 12-15% annually, driven by higher sales volumes and rural expansion.

In terms of profitability, while operating margins have faced pressure due to raw material costs, the company has maintained a net profit margin of approximately 3-5%, reflecting efficient cost management. For instance, its FY2023 revenue crossed ₹55,000 crores, marking a significant milestone.

As Adani Wilmar continues to diversify and focus on higher-margin products, its financial performance is expected to improve, supporting projected share price targets of ₹450 by 2025 and ₹750 by 2030.

Also Read: Jio Finance Share Price Target & Prediction 2025, 2026, 2027, 2030, 2035, 2040, 2045, and 2050

Also Read: Network18 Share Price Forecast and Targets for 2025 to 2030

FAQs: Adani Wilmar Ltd

Does Adani Wilmar pay dividends?

Adani Wilmar typically focuses on reinvesting its profits to expand its business rather than paying significant dividends. This approach supports its growth strategy, particularly in its core segments like edible oils and packaged food.

What is Adani Wilmar’s market position in the FMCG sector?

Adani Wilmar holds a strong position in the Indian FMCG sector, particularly in edible oils, with its popular Fortune brand. Its extensive distribution network helps it compete effectively with major players, making it a leader in the sector.

Is Adani Wilmar debt-free?

Adani Wilmar is not entirely debt-free. Like many growth-oriented companies, it uses debt to fund its operations and expansion. However, its debt-to-equity ratio is within manageable limits, reflecting prudent financial management.

Is Adani Wilmar expected to become a multi-bagger stock?

Yes, Adani Wilmar has the potential to become a multi-bagger stock. With the growing demand for FMCG products in India, the company’s aggressive expansion plans could drive substantial growth. By 2030, its stock price could reach ₹1100–₹1200.

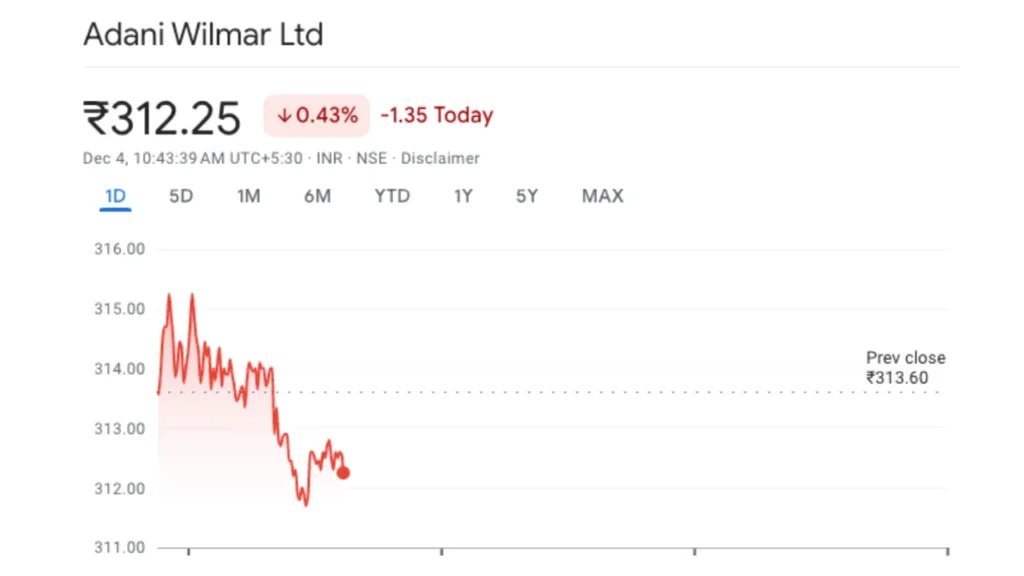

How has Adani Wilmar performed recently in the stock market?

Adani Wilmar has seen fluctuations but continues to show resilience. The stock is expected to reach between ₹525 and ₹575 in 2025, reflecting steady growth as the company strengthens its market position.

What is the all-time high of Adani Wilmar’s share price?

Adani Wilmar’s all-time high was recorded shortly after its IPO, driven by strong investor confidence. The stock is expected to continue growing, with predictions for 2030 ranging between ₹1100–₹1200.

Conclusion

Adani Wilmar’s growth trajectory is promising, driven by its market leadership in edible oils and expanding presence in the FMCG sector. The company’s diversification into value-added products, strategic market penetration, and its strong financial management position it well for long-term growth. With solid backing from Adani Group and Wilmar International, Adani Wilmar is poised to benefit from India’s growing demand for packaged foods and household products.

Based on our price predictions, Adani Wilmar’s stock is expected to experience steady growth over the next few years, with significant potential in the long term. While there are some risks to consider, particularly in terms of competition and fluctuating commodity prices, the company’s strong growth strategy and focus on innovation make it a potentially rewarding investment.

Investors should consider these factors while deciding if Adani Wilmar aligns with their long-term investment goals.

1 thought on “Adani Wilmar Share Price Target and Predictions (2025–2050)”