Digital World Acquisition Corp (DWAC) has captured significant attention in the financial world, thanks to its high-profile merger with Trump Media & Technology Group (TMTG), the company behind Truth Social. Positioned as a challenger to mainstream social media platforms, Truth Social aims to offer an alternative space for free speech, which has sparked both enthusiasm and controversy.

Since investors want to buy DWAC stock, they may be interested to know about the company’s outlook for the upcoming year.. This article will provide DWAC Stock Price Prediction & Forecast for 2024, 2025, 2026, 2027, 2030, 2035, and 2040, 2050. Read the article at the end to know potential future of DWAC.

Digital World Acquisition Corp. (DWAC) Details

| Company Name | Digital World Acquisition Corp. |

| Ticker Symbol | DWAC |

| Founded | 2020 |

| Key Product | Truth Social (Social Media Platform) |

| Industry | Media & Technology |

| Headquarters | Miami, Florida, USA |

| CEO | Patrick Orlando |

| Merger Announcement Date | October 2021 |

| Stock Exchange | NASDAQ |

| Revenue | $35.86 M |

| Net Income | $2.96 million |

| Total Assets | $0.31 B. |

| Market Cap | $1.85 Billion |

| 52- week High/Low | $56.72/$42.34 |

DWAC Stock Price Prediction & Forecasts

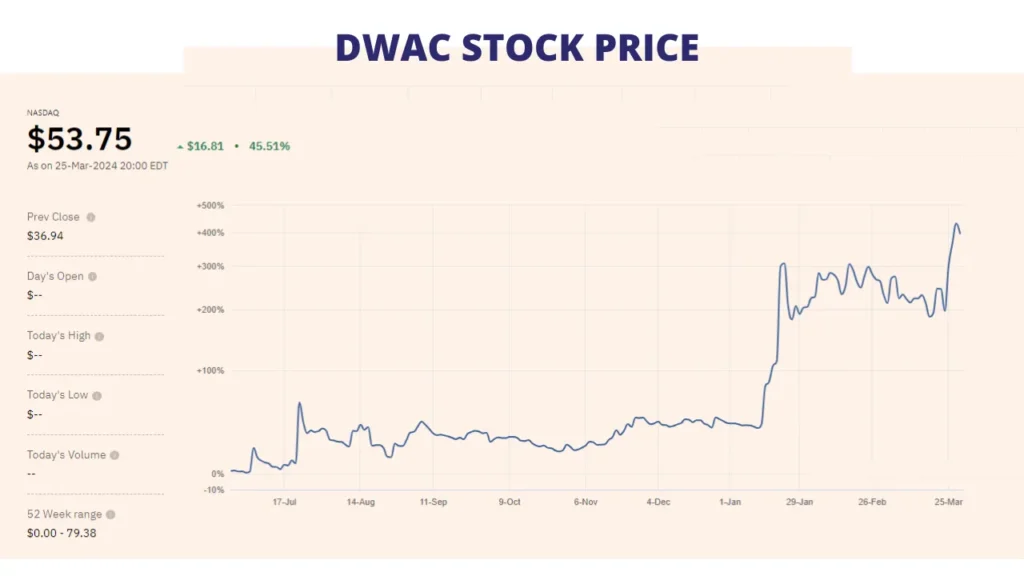

DWAC Stock Price Prediction & Forecasts 2024

- High Price: $57.25

- Average Price: $53.75

- Low Price: $49.44

In 2024, DWAC’s stock price is expected to see a high of $57.25, an average price of $53.75, and a low of $49.44. This forecast reflects a moderate growth of 7% as the company continues to stabilize post-merger and expand its user base on Truth Social.

DWAC Stock Price Prediction & Forecasts 2025

- High Price: $65.12

- Average Price: $61.23

- Low Price: $55.21

For 2025, predictions indicate a high of $65.12, an average of $61.23, and a low of $55.21, with a growth percentage of 13.9%. The growth is anticipated due to increased user engagement and potential expansion of services on Truth Social, along with possible new product launches.

DWAC Stock Price Prediction & Forecasts 2026

- High Price: $73.15

- Average Price: $67.24

- Low Price: $62.90

In 2026, DWAC’s stock could reach a high of $73.15, with an average price of $67.24, and a low of $62.90, reflecting a growth percentage of 12.3%. This forecast suggests continued user growth and revenue diversification, as well as strategic partnerships that could enhance platform functionality.

DWAC Stock Price Prediction & Forecasts 2027

- High Price: $83.17

- Average Price: $75.00

- Low Price: $69.00

By 2027, the stock is forecasted to hit a high of $83.17, an average of $75.00, and a low of $69.00, indicating a growth percentage of 11.5%. This reflects the company’s expected maturation in the market, with sustained user growth and increased monetization strategies contributing to higher stock valuation.

DWAC Stock Price Prediction & Forecasts 2030

- High Price: $98.00

- Average Price: $90.18

- Low Price: $84.28

In 2030, DWAC is predicted to see a high of $98.00, an average price of $90.18, and a low of $84.28, with a growth percentage of 20%. The growth projection includes the company’s potential for technological advancements, increased market share, and broader adoption of Truth Social.

DWAC Stock Price Prediction & Forecasts 2035

- High Price: $118.85

- Average Price: $111.07

- Low Price: $105.87

For 2035, forecasts suggest a high of $118.85, an average of $111.07, and a low of $105.87, reflecting a growth percentage of 23.9%. This long-term outlook is based on the assumption that DWAC will successfully navigate the competitive social media landscape and continue to innovate.

DWAC Stock Price Prediction & Forecasts 2040

- High Price: $146.93

- Average Price: $138.80

- Low Price: $131.88

In 2040, the stock is expected to reach a high of $146.93, an average price of $138.80, and a low of $131.88, with a growth percentage of 32.5%. This reflects significant growth driven by sustained market presence, potential new product lines, and continued user base expansion.

DWAC Stock Price Prediction & Forecasts 2050

- High Price: $232.00

- Average Price: $205.15

- Low Price: $192.00

By 2050, DWAC’s stock could see a high of $232.00, an average of $205.15, and a low of $192.00, with a growth percentage of 57.9%. This ambitious forecast assumes DWAC will become a major player in the social media industry, with a diverse portfolio and a robust global presence.

DWAC Stock Price Prediction & Forecasts 2024, 2025, 2026, 2027, 2030, 2040, and 2050

| Year | High Price | Average Price | Low Price | Growth Percentage |

|---|---|---|---|---|

| 2024 | $57.25 | $53.75 | $49.44 | 7% |

| 2025 | $65.12 | $61.23 | $55.21 | 13.9% |

| 2026 | $73.15 | $67.24 | $62.90 | 12.3% |

| 2027 | $83.17 | $75.00 | $69.00 | 11.5% |

| 2030 | $98.00 | $90.18 | $84.28 | 20% |

| 2035 | $118.85 | $111.07 | $105.87 | 23.9% |

| 2040 | $146.93 | $138.80 | $131.88 | 32.5% |

| 2050 | $232.00 | $205.15 | $192.00 | 57.9% |

| 2070 | $660,900.00 | $610,900.05 | $605,900.90 | 297,798.9% |

Is DWAC a good stock to buy?

The merger of Digital World Acquisition Corp. (DWAC) with Trump Media & Technology Group, the company behind Truth Social, gained a lot of interest.

Given Truth Social’s specialized appeal to users looking for an alternative to conventional social media, this well-known association could increase stock value.

With expected stock prices rising from an average of $53.75 in 2024 to $205.15 by 2050, DWAC shows substantial growth potential.

But there are significant challenges associated with the investment, such as political controversy and strong rivalry from well-established social media giants.

Furthermore, a company’s operations may be impacted by regulatory scrutiny that results from high visibility. If you believe in Truth Social’s vision and are comfortable with these risks, DWAC could be a worthwhile investment.

Is DWAC a high-risk stock?

Yes, DWAC is considered a high-risk stock. Its merger with Trump Media & Technology Group, the company behind Truth Social, brings both potential and controversy. While the association with Trump can attract significant attention and drive up the stock value, it also comes with political baggage that may deter some investors.

Moreover, DWAC is entering a fiercely competitive social media market dominated by established giants like Facebook and Twitter. There’s also the risk of regulatory scrutiny given its high profile, which could impact its operations.

If you’re comfortable with these risks and believe in the long-term vision of Truth Social, DWAC might be a good investment. However, it’s essential to approach it with caution and consider diversifying your investments to manage potential downsides.

Is DWAC stock buy or sell?

DWAC buying and selling of stocks are dependent on your risk level and investment strategy. DWAC presents a high-reward but high-risk potential through the formation of Truth Social and its merger with Trump Media & Technology Group.

Buying DWAC stock could be an effective financial choice if you think Truth Social has the potential to become a popular alternative social media network and you can handle the political backlash and regulatory attention it might attract.

Selling or staying away from DWAC, however, would be a better option if you value stability and are worried about the fierce rivalry from well-established giants like Facebook and Twitter, in addition to the possibility of legal and political hurdles. In the end, your choice should be in line with your risk tolerance and financial objectives.

FAQ: Digital World Acquisition Corp.

What is the all-time high of DWAC?

The all-time high of DWAC (Digital World Acquisition Corp.) is $175.00, which it reached in October 2021.

Why did DWAC stock go up?

DWAC stock surged primarily due to its announcement of a merger with Trump Media & Technology Group, the company behind the social media platform Truth Social. The association with former President Donald Trump generated significant investor interest and speculation about the platform’s potential impact in the social media space, driving up the stock price.

Why is DWAC falling?

DWAC stock is falling due to several factors, including regulatory scrutiny, the volatile nature of SPAC (Special Purpose Acquisition Company) stocks, and the challenges associated with launching and sustaining a new social media platform in a competitive market. Additionally, political controversies linked to its association with Trump Media & Technology Group can contribute to investor uncertainty and fluctuating stock prices.

Does DWAC pay dividends?

At this time, Digital World Acquisition Corp. (DWAC) is not paying dividends. DWAC and other SPACs prioritize the acquisition of privately owned companies and their potential public listing over paying dividends to shareholders. This strategy, as compared to dividend payments on a regular basis, tries to optimize growth potential through acquisitions.

How long has DWAC been in business?

Digital World Acquisition Corp. (DWAC) was incorporated on July 20, 2020. Therefore, as of mid-2024, DWAC has been in business for approximately four years.

What is the full form of DWAC?

The full form of DWAC is “Digital World Acquisition Corp.”

Should I invest in Truth Social?

Taking DWAC to invest in Truth Social carries a risk. The Trump-related platform is very popular but has generated a lot of controversy. It is under regulatory scrutiny, has few users, declines in value, and is highly valued. User growth is difficult when you have to compete with major players like Facebook and Twitter. Before moving forward, carefully compare these risks to your investment objectives.

Conclusion

Finally, investing in Digital World Acquisition Corp. (DWAC), linked to Truth Social and Trump Media & Technology Group, offers significant growth potential but comes with substantial risks. Stock prices are predicted to increase from $53.75 in 2024 to $205.15 in 2050. However, because of regulatory scrutiny, competitive pressure, and political controversy, the investment carries a significant risk. DWAC might be profitable if you agree with Truth Social’s vision and can take these risks.

Must Read: DJT stock price prediction & Forecast 2024, 2025, 2026, 2027, 2030, 2035, and 2040, 2050

2 thoughts on “DWAC Stock Price Prediction & Forecast for 2024, 2025, 2026, 2027, 2030, 2035, and 2040, 2050”