National Aluminum Company Limited (NALCO) is one of the largest public-sector enterprises in India, specializing in the production of aluminum. Founded in 1981, the company has played a crucial role in supporting India’s growth by producing high-quality aluminum for various industries, from automotive to construction and electrical. Headquartered in Bhubaneswar, Odisha, NALCO is also known for its strong commitment to sustainable practices and its contribution to the nation’s economy.

NALCO operates throughout aluminum production, from bauxite mining to refining and melting. With state-of-the-art facilities, it is a key player in the global aluminum market. The company is also a part of the Ministry of Mines, under the Government of India, which supports its long-term growth and stability.

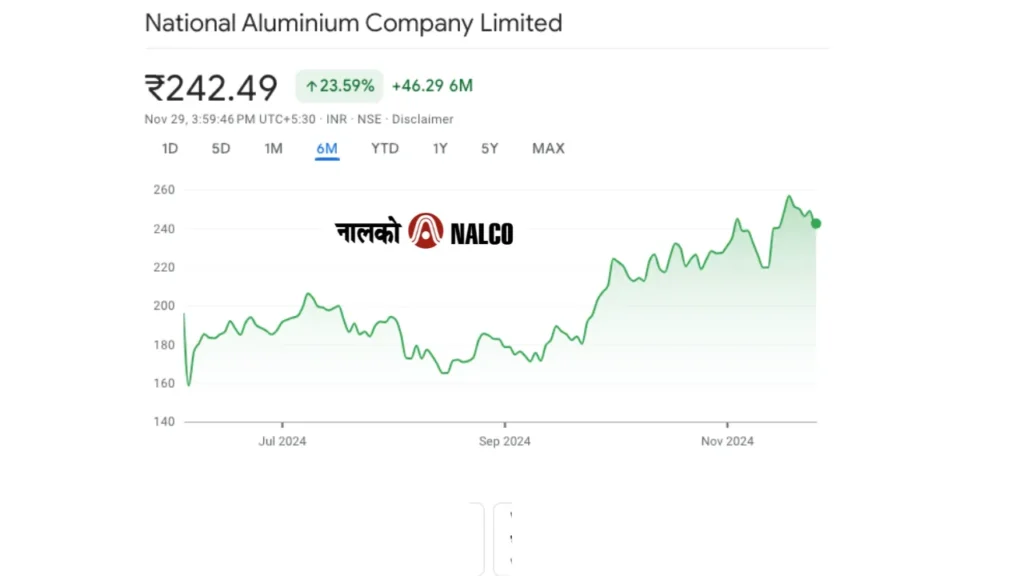

As India continues to push for greater industrialization and infrastructure development, NALCO is well-positioned to benefit from increasing demand for aluminum. In this article, we’ll discuss NALCO’s stock price targets from 2025 to 2030, giving you an insight into its potential growth and whether it might be a good investment for the future.

NALCO Share Price Target for 2025

In 2025, NALCO’s share price is expected to range between ₹90 and ₹110. This is based on the company’s stable production levels, increased domestic aluminum demand, and export growth. The government’s push for infrastructure and renewable energy projects is likely to drive demand for aluminum, benefiting NALCO.

NALCO Share Price Target for 2026

By 2026, projections indicate the stock may reach ₹110–₹130. The company’s focus on operational efficiency and sustainability initiatives, coupled with strong commodity cycles, could bolster its revenue. Expansion in international markets could also contribute to its stock growth.

NALCO Share Price Target for 2027

For 2027, NALCO’s price target ranges from ₹130 to ₹150. The anticipated rise is supported by expected global aluminum demand and the company’s investments in new technologies. Further developments in downstream aluminum production could also positively impact the stock.

NALCO Share Price Target for 2028

In 2028, NALCO may achieve a share price of ₹150–₹180. The company’s ability to diversify its revenue streams and focus on value-added aluminum products will be key drivers. Additionally, global shifts towards electric vehicles and green infrastructure will likely increase aluminum demand.

NALCO Share Price Target for 2029

By 2029, predictions suggest NALCO could see its share price range between ₹180 and ₹210. With aluminum playing a critical role in renewable energy and electric mobility projects, NALCO stands to benefit from these trends, solidifying its market position.

NALCO Share Price Target for 2030

In 2030, NALCO’s share price is expected to range from ₹210 to ₹250. The long-term focus on green energy and the company’s capacity expansions will likely drive significant growth. Continued government backing for the metals sector is another factor enhancing NALCO’s outlook.

Consolidated Price Targets for NATIONALUM (2025–2030)

| Year | High Target (₹) | Medium Target (₹) | Low Target (₹) |

|---|---|---|---|

| 2025 | 110 | 100 | 90 |

| 2026 | 130 | 120 | 110 |

| 2027 | 150 | 140 | 130 |

| 2028 | 180 | 160 | 150 |

| 2029 | 210 | 190 | 180 |

| 2030 | 250 | 230 | 210 |

Is NALCO a good buy?

Yes, NALCO (National Aluminium Company Limited) is considered a good buy for long-term investors. As one of India’s leading producers of aluminum and alumina, it plays a critical role in the infrastructure, renewable energy, and automotive sectors. Backed by strong government policies and financial stability, NALCO is poised to benefit from India’s industrial growth.

Its share price predictions are promising, with targets of ₹110 by 2025 and up to ₹200–₹220 by 2030, reflecting growth in demand for aluminum globally and expansion in its capacity. NALCO’s focus on sustainability and diversification adds to its appeal.

However, investors should remain mindful of risks such as fluctuations in aluminum prices and regulatory changes. For those looking to invest in India’s growing industrial and energy sectors, NALCO offers a solid opportunity for steady growth.

Is Nalco a profitable company?

Yes, NALCO (National Aluminium Company Limited) is a profitable company. It has consistently reported strong financial performance driven by its efficient operations and growing demand for aluminum and alumina. For example, in recent years, NALCO has achieved healthy revenues and profit margins due to robust export demand and favorable commodity pricing.

The company’s cost-effective production techniques and government support as a public sector undertaking (PSU) further enhance its profitability. With expansion plans in the pipeline and India’s infrastructure boom boosting aluminum demand, NALCO is expected to remain profitable in the foreseeable future. However, like any commodity-based company, its profitability may be influenced by global aluminum prices and input cost fluctuations.

Is NALCO overvalued or undervalued?

NALCO (National Aluminium Company Limited) is widely considered undervalued based on its financial metrics and growth prospects. The company consistently delivers strong earnings, with a net profit of ₹1,544 crore in FY23, showcasing its resilience amidst fluctuating aluminum prices. NALCO’s P/E ratio is often below the industry average, reflecting its potential for value investors.

Its intrinsic value is supported by access to high-grade bauxite reserves and a low-cost production model, making it competitive globally. With a market cap of ₹30,000+ crore (as of 2024) and dividend yields typically over 6%, it appeals to both growth and income-focused investors.

As aluminum demand grows, especially for renewable energy, electric vehicles, and infrastructure projects, NALCO’s expansion plans in refining capacity further bolster its valuation. Investors should, however, monitor aluminum price trends and global market dynamics to assess whether the stock is fairly valued for long-term gains.

Also Read: IREDA Share Forecast: Share Price Targets and Growth Predictions for 2025 to 2030

FAQs About NALCO Stock

What is the target price of NALCO stock?

The target price for NALCO stock is expected to rise gradually over the next few years. In 2025, the stock is projected to reach a high of ₹110, with medium and low targets of ₹90, respectively. By 2030, NALCO’s stock could potentially reach ₹250 at its highest, with medium and low targets of ₹230 and ₹210.

Is NALCO debt-free?

NALCO is not completely debt-free, but it has maintained a healthy balance sheet. The company’s debt levels are manageable, and its strong cash flow allows it to meet obligations without significant financial strain. NALCO’s debt-to-equity ratio is relatively stable, supporting its profitability.

What is the target price of NALCO in 2025?

In 2025, NALCO’s stock is expected to have a target range of ₹90–₹110, reflecting moderate growth due to the company’s solid position in the Indian metals sector and the rising demand for aluminum.

What is the record date for the NALCO dividend in 2024?

The record date for the NALCO dividend in 2024 will be announced closer to the date of the dividend declaration. Investors should keep an eye on official announcements from the company for the precise date.

Which is better, Nalco or Hindalco?

While both Nalco and Hindalco are prominent players in the aluminum industry, Hindalco is a larger and more diversified company with a broader portfolio in metals and related products. NALCO, on the other hand, focuses more on aluminum and benefits from a strong domestic presence in India. Hindalco may offer more growth opportunities due to its scale, but NALCO can be appealing to those looking for a stable player in the aluminum sector.

Does NALCO give bonus shares?

NALCO has a history of issuing dividends rather than bonus shares. While the company does not regularly offer bonus shares, its strong financial performance and stable dividend payouts make it an attractive choice for long-term investors.

Is NALCO a small-cap company?

NALCO is not a small-cap company. It is considered a large-cap company due to its significant market capitalization, industry presence, and consistent financial performance within the Indian metals sector. It ranks among the leading aluminum producers in India.

Also Read: Tata Steel Share Price Target & Prediction 2025 to 2030: A Comprehensive Analysis

Finally, NALCO shows promising potential for long-term investors, backed by its strong position in the aluminum industry. As the company continues to expand, its share price is expected to grow steadily over the next several years. If you’re looking for a reliable investment, NALCO could be a great addition to your portfolio. Keep an eye on market trends and NALCO’s progress to make informed decisions on your investment journey.

1 thought on “NALCO Share Price Targets: Future Outlook for 2025–2030”