Reliance Power Share Price Target & Prediction 2025, 2026, 2027, 2030, 2035, 2040, and 2050

Reliance Power, part of the Reliance Group, has established itself as one of India’s leading power companies, with a diversified portfolio in thermal, hydro, and renewable energy. As India’s energy demands continue to grow, Reliance Power is well-positioned to benefit from the country’s infrastructure and energy transformation.

In this article, we will explore the share price target & predictions for Reliance Power in 2025, 2026, 2027, 2030, 2035, 2040, and 2050 and provide insights into its future prospects.

Reliance Power Share Details

| Parameter | Details |

|---|---|

| Company Name | Reliance Power Limited |

| Sector | Power, Renewable Energy |

| Established | 1995 |

| Headquarters | Mumbai, India |

| Owner | Mukesh Ambani (Reliance Group) |

| Main Business | Power generation, Transmission, Distribution |

| Market Cap | ₹4,500 Crores (Approx., 2024) |

| 52-Week High | ₹25 |

| 52-Week Low | ₹10 |

Reliance Power Share Price Target & Prediction

Reliance Power Share Price Target & Prediction 2025

In 2025, Reliance Power is expected to see steady growth, primarily due to its increased focus on renewable energy sources such as solar, wind, and hydroelectric power. The share price is forecast to range from ₹20 (low) to ₹30 (high) as the company continues to scale its clean energy projects.

| Year | High Price (₹) | Medium Price (₹) | Low Price (₹) |

|---|---|---|---|

| 2025 | 30 | 25 | 20 |

Reliance Power Share Price Target & Prediction 2026

By 2026, Reliance Power’s expansion in the renewable energy sector is likely to lead to higher returns, with its share price projected to range between ₹30 to ₹40. Market conditions and government support for clean energy initiatives could further boost investor confidence.

| Year | High Price (₹) | Medium Price (₹) | Low Price (₹) |

|---|---|---|---|

| 2026 | 40 | 35 | 30 |

Reliance Power Share Price Target & Prediction 2027

In 2027, as Reliance Power continues to capitalize on renewable projects and the country’s increasing energy demand, its share price could see significant growth. The price may range between ₹40 and ₹55, reflecting its expanding market presence.

| Year | High Price (₹) | Medium Price (₹) | Low Price (₹) |

|---|---|---|---|

| 2027 | 55 | 47 | 40 |

Reliance Power Share Price Target & Prediction 2030

By 2030, Reliance Power’s investments in renewable energy are expected to mature, pushing the stock price to a higher range of ₹60 to ₹85. The increasing demand for sustainable energy in India is likely to fuel the company’s growth, providing strong returns to investors.

| Year | High Price (₹) | Medium Price (₹) | Low Price (₹) |

|---|---|---|---|

| 2030 | 85 | 75 | 60 |

Reliance Power Share Price Target & Prediction 2035

In 2035, the company’s focus on sustainable energy, along with its expansion plans, could lead to substantial growth in its stock value. Reliance Power’s share price may range between ₹100 to ₹150 as it takes a leading role in India’s energy transition.

| Year | High Price (₹) | Medium Price (₹) | Low Price (₹) |

|---|---|---|---|

| 2035 | 150 | 125 | 100 |

Reliance Power Share Price Target & Prediction 2040

By 2040, Reliance Power could become a major player in the global renewable energy market, which would drive its stock price to new heights. It’s expected to be valued between ₹200 and ₹300, driven by both domestic and international market opportunities.

| Year | High Price (₹) | Medium Price (₹) | Low Price (₹) |

|---|---|---|---|

| 2040 | 300 | 250 | 200 |

Reliance Power Share Price Target & Prediction 2050

In 2050, Reliance Power’s large-scale renewable energy projects could place it at the forefront of India’s and even global energy sector. The share price could see significant appreciation, ranging from ₹400 to ₹600, fueled by its sustained growth in clean energy.

| Year | High Price (₹) | Medium Price (₹) | Low Price (₹) |

|---|---|---|---|

| 2050 | 600 | 500 | 400 |

Reliance Power Share Price Target & Prediction in Table

| Year | High Price (₹) | Medium Price (₹) | Low Price (₹) |

|---|---|---|---|

| 2025 | 30 | 25 | 20 |

| 2026 | 40 | 35 | 30 |

| 2027 | 55 | 47 | 40 |

| 2030 | 85 | 75 | 60 |

| 2035 | 150 | 125 | 100 |

| 2040 | 300 | 250 | 200 |

| 2050 | 600 | 500 | 400 |

Is Reliance Power a good buy for long-term?

Reliance Power is well-positioned for long-term growth, especially with its expanding focus on renewable energy. As India transitions to cleaner energy sources, Reliance Power’s strategic investments could yield substantial returns over the years. For long-term investors, this stock offers strong growth potential, particularly in green energy.

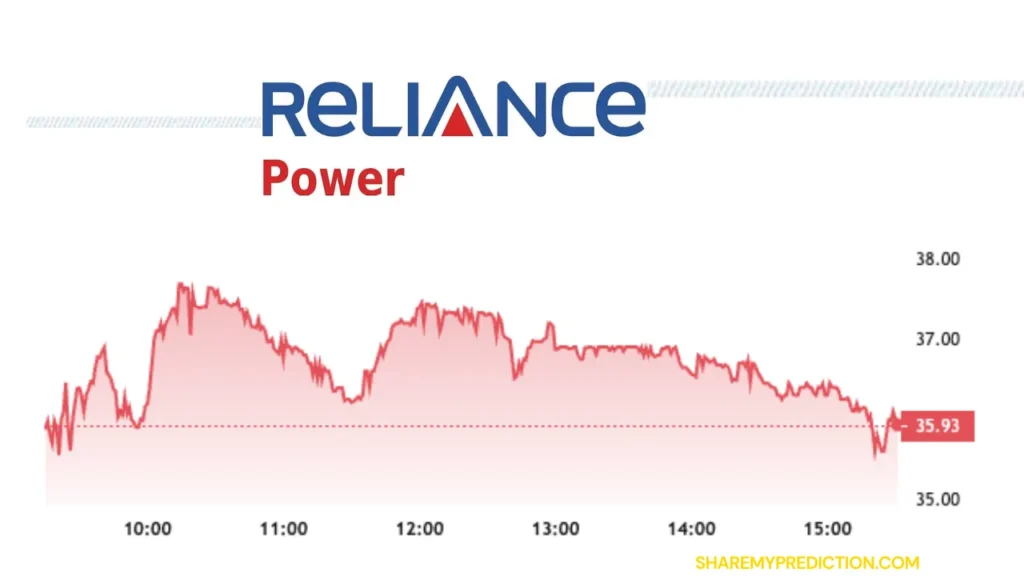

Why is Reliance Power falling?

The fall in Reliance Power’s share price may be attributed to short-term factors such as market volatility, project delays, or fluctuations in energy prices. However, these are often temporary setbacks, and the company’s long-term fundamentals, especially in the renewable energy sector, remain strong.

Can I invest in Reliance Power?

Yes, Reliance Power is a good investment option, especially for long-term investors. As the company expands its renewable energy capacity, it offers a promising opportunity to benefit from India’s growing demand for clean energy. However, as with any investment, it is essential to consider market conditions and consult with a financial advisor.

Also Read: IRB Infra Share Price Target & Prediction 2025, 2026, 2027, 2030, 2035, 2040, and 2050

FAQs: Reliance Power Share

What is the prediction of Reliance Power?

Reliance Power is expected to see gradual price increases as the company expands its renewable energy portfolio and executes large infrastructure projects. The stock is expected to appreciate over the next few years.

Is Reliance Power profitable?

Yes, Reliance Power has been profitable, thanks to its diversified power generation assets, including thermal and renewable energy. With growing investments in renewables, profitability is expected to improve further.

What is the target price of Reliance stock in 2024?

The target price of Reliance Power in 2024 is expected to range between ₹20 and ₹30, based on its continued focus on expanding renewable energy projects.

Can Reliance Power be a multibagger?

Reliance Power has the potential to be a multibagger in the long term, especially if its renewable energy projects scale up successfully. Investors looking for long-term growth could see significant returns.

What are the future plans of Reliance Power?

Reliance Power plans to expand its renewable energy capacity, focusing on solar, wind, and hydroelectric power projects, which will drive future growth.

Also Read: IRB Infra Share Price Target & Prediction 2025, 2026, 2027, 2030, 2035, 2040, and 2050

Conclusion

Reliance Power is well-positioned to grow in the renewable energy sector, making it an attractive option for investors seeking long-term growth. As India continues to focus on sustainable energy solutions, Reliance Power is set to benefit from this transformation. Whether you are looking for steady growth or a multibagger opportunity, Reliance Power could be a solid addition to your portfolio for the years to come.

2 thoughts on “Reliance Power Share Price Target & Prediction 2025, 2026, 2027, 2030, 2035, 2040, and 2050”